Pump and Dump Schemes: A Comprehensive Guide

Related Articles: Pump and Dump Schemes: A Comprehensive Guide

- Security Tokens

- Cryptocurrency Mining

- Airdrop

- The Ultimate Guide to Cryptocurrency: A Journey into the Digital Realm

- Fundamental analysis

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Pump and Dump Schemes: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Pump and Dump Schemes: A Comprehensive Guide

Pump and Dump Schemes: A Comprehensive Guide

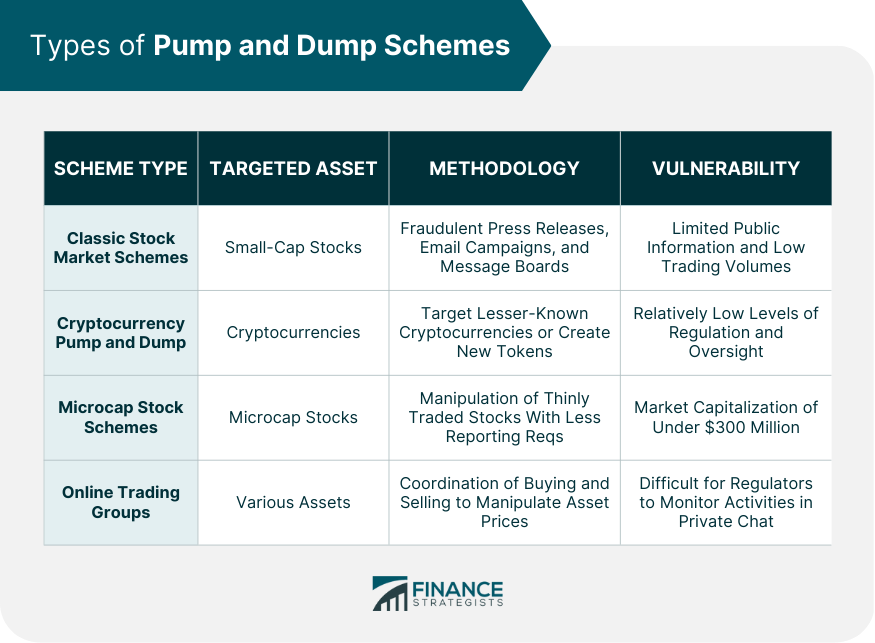

Pump and dump schemes are a type of securities fraud that involves artificially inflating the price of an asset (typically a penny stock) and then selling it at a high price, causing a sharp decline in the asset’s value. This leaves investors who bought the asset at the inflated price with significant losses.

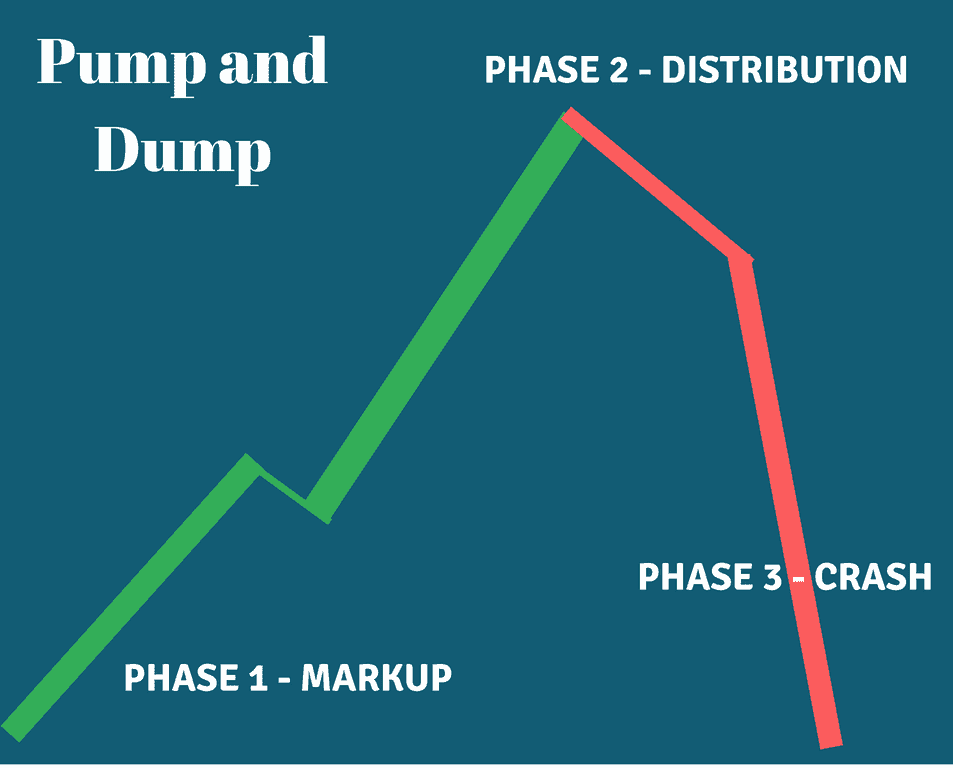

How Pump and Dump Schemes Work

Pump and dump schemes typically involve a group of individuals who work together to manipulate the price of a particular asset. The scheme usually begins with the perpetrators acquiring a large number of shares of the asset at a low price. They then use various methods to artificially inflate the price of the asset, such as spreading false or misleading information about the asset, creating a sense of urgency among potential buyers, or using social media to generate hype.

Once the price of the asset has been inflated to a certain level, the perpetrators sell their shares at a high price, making a significant profit. As soon as they have sold their shares, the price of the asset typically plummets, leaving other investors who bought the asset at the inflated price with significant losses.

Who Are the Victims of Pump and Dump Schemes?

Pump and dump schemes primarily target unsophisticated investors who are not familiar with the risks involved in investing in penny stocks or other low-priced assets. These investors are often lured into the scheme by the promise of quick profits, and they may not be aware of the manipulative tactics used by the perpetrators.

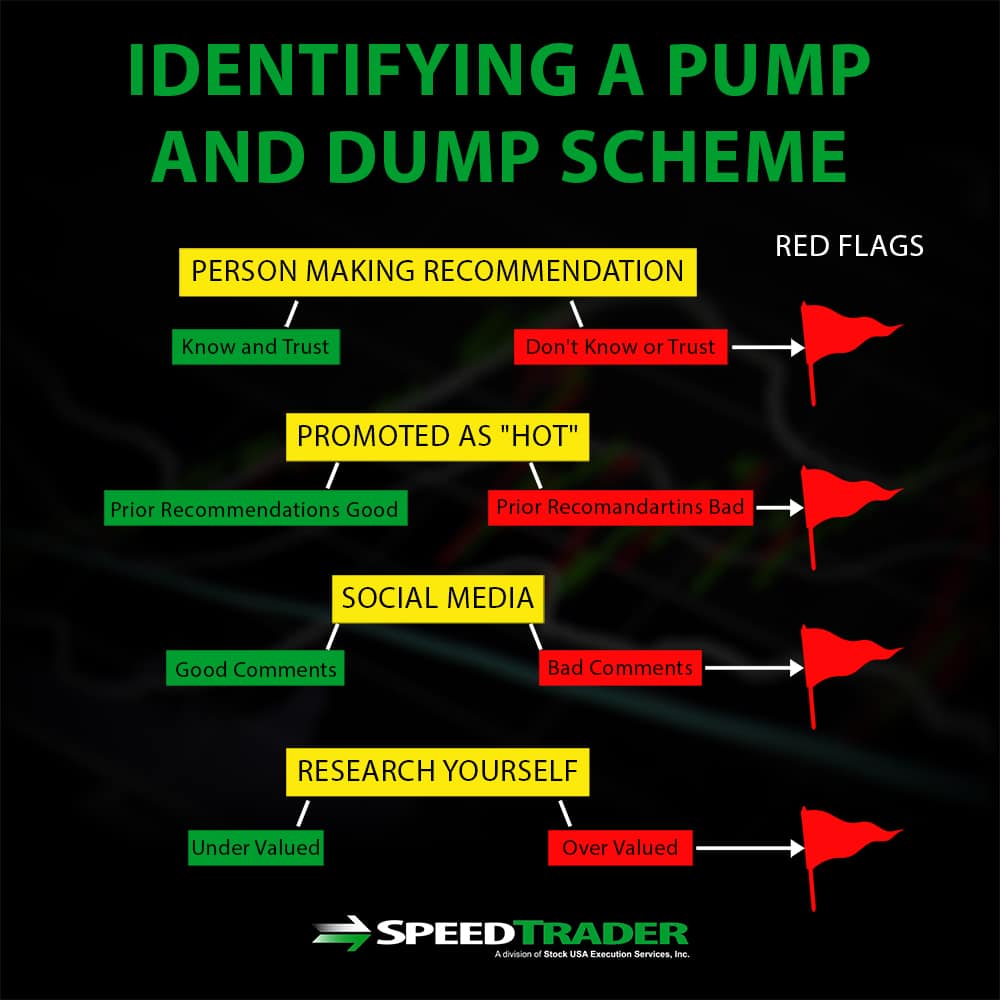

Identifying a Pump and Dump Scheme

There are several red flags that can indicate a potential pump and dump scheme. These include:

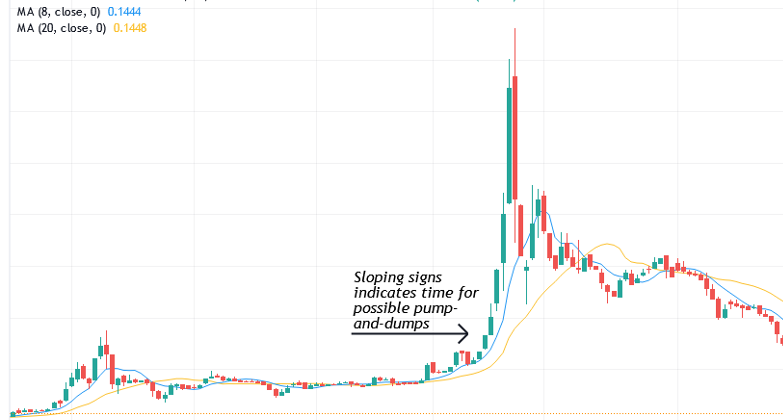

- Sudden and significant price increases: A sudden and dramatic increase in the price of an asset, without any apparent news or events to justify it, can be a sign of a pump and dump scheme.

- High trading volume: An unusually high volume of trading in an asset can also indicate a pump and dump scheme. This is because the perpetrators need to buy and sell a large number of shares to inflate the price.

- Suspicious online activity: The perpetrators of a pump and dump scheme often use social media and online forums to spread false or misleading information about the asset. Be wary of any unsolicited messages or posts that promote a particular asset.

- Lack of transparency: If there is a lack of transparency about the asset or the company that issued it, this could be a sign of a pump and dump scheme.

- Unusual stock price movements: The price of the stock may fluctuate wildly, with large spikes and dips.

How to Protect Yourself from Pump and Dump Schemes

There are several steps you can take to protect yourself from pump and dump schemes:

- Do your research: Before investing in any asset, make sure to do your research and understand the risks involved.

- Be wary of unsolicited investment advice: Be skeptical of any unsolicited investment advice, especially if it comes from an unknown source.

- Avoid investing in penny stocks or other low-priced assets: Penny stocks are often more susceptible to pump and dump schemes, so it’s best to avoid them.

- Don’t invest more than you can afford to lose: It’s crucial to invest only the amount of money that you can afford to lose.

- Diversify your investments: Diversifying your investments can help reduce your risk.

The Role of Social Media in Pump and Dump Schemes

Social media has become a significant tool for perpetrators of pump and dump schemes. They use platforms like Twitter, Telegram, and Discord to spread false or misleading information about the asset, create a sense of urgency among potential buyers, and generate hype.

The anonymity and reach of social media make it an ideal platform for carrying out pump and dump schemes. Perpetrators can easily create fake accounts and spread their messages to a large audience without being easily identified.

The Legal Ramifications of Pump and Dump Schemes

Pump and dump schemes are illegal and can result in severe penalties. Perpetrators can face criminal charges, including securities fraud, which can lead to significant fines and imprisonment.

The Securities and Exchange Commission (SEC) actively investigates and prosecutes pump and dump schemes. The SEC has the power to issue cease-and-desist orders, impose fines, and seek injunctions to prevent further wrongdoing.

Conclusion

Pump and dump schemes are a serious form of securities fraud that can result in significant financial losses for investors. By understanding how these schemes work and taking steps to protect yourself, you can reduce your risk of becoming a victim. Remember to always do your research, be wary of unsolicited investment advice, and diversify your investments. If you suspect a pump and dump scheme, report it to the SEC.

Closure

Thus, we hope this article has provided valuable insights into Pump and Dump Schemes: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!